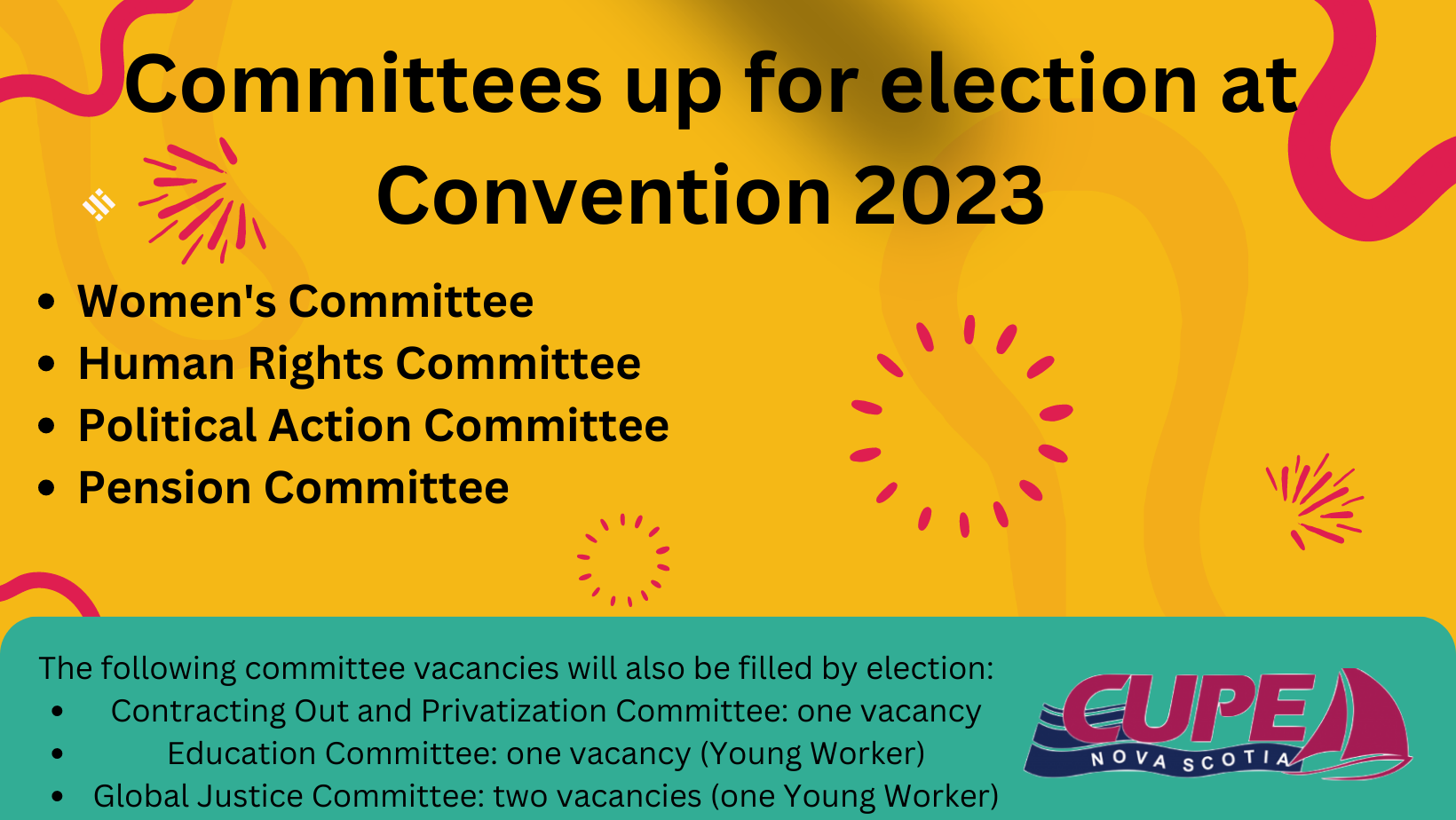

CUPE Nova Scotia Committee Vacancies

Being a CUPE NS committee member is a great way to learn more about CUPE NS, our principles and goals. Your participation on a committee offers new perspectives to the committee and helps us grow as a union. As a committee member you become Read more […]