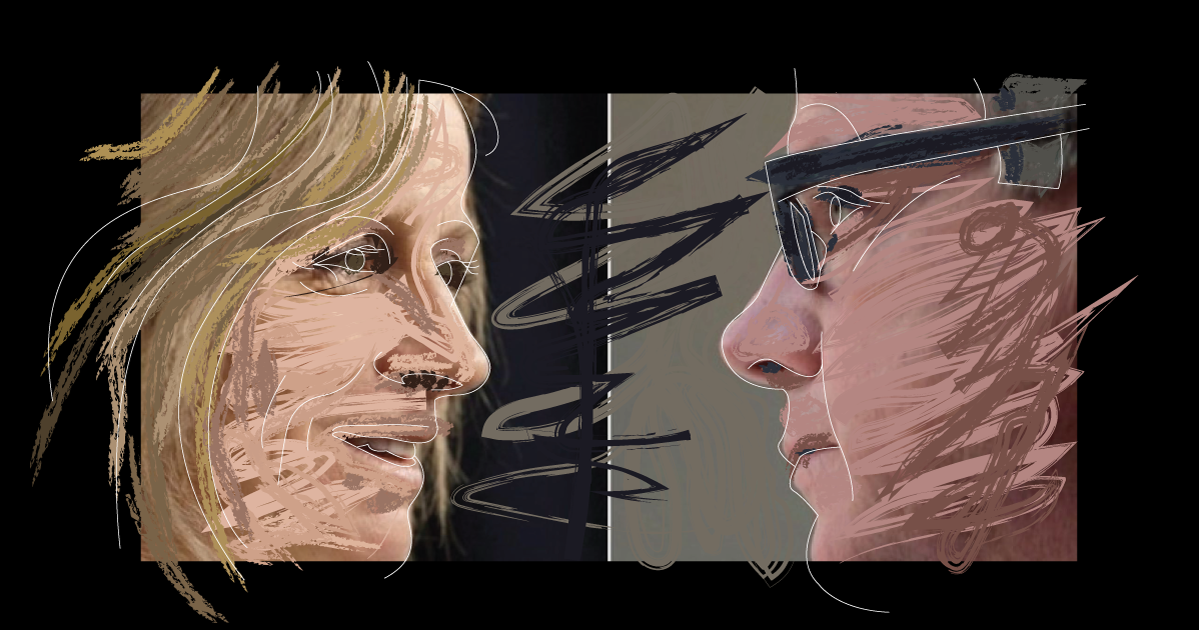

There is no better example of budgets being about political choices than a comparison of the Alberta and Saskatchewan budgets.

Alberta’s budget invested in infrastructure and public services while Saskatchewan went with cuts and tax hikes for everyone except corporations (who got a tax break).

Alberta’s reliance on revenue from oil and gas has had a ‘boom and bust’ effect on government revenue for decades. When oil and gas prices were high, the province racked up huge surpluses, and when prices dropped, deficits appeared. During the 44-year reign of the Alberta Conservatives, the approach to low resource prices was to slash public services and raise user fees and taxes. The Ralph Klein government cut public sector wages by five per cent, laid off public sector workers and privatized public work, and cut funding to health care and education. Health care premiums were hiked, alcohol taxes raised, and Albertans faced a wide range of new user fees.

Following the 2015 collapse of oil prices, conservatives of all stripes are again calling for cuts to public sector wages, reduced spending, and slashing the programs people depend on.

But in three budgets since forming office, the Alberta NDP has taken the opposite approach, holding the line on spending, and protecting public sector workers from cuts. The NDPincreased infrastructure funding – spending on the construction of schools, hospitals, roads and other assets. Spending was largely cut in the last decade of rapid growth in Alberta, and Alberta Premier Rachel Notley argues the province has a lot of catching up to do.

Notley and the NDP argue that following the route of the Wildrose and Conservative opposition would lead to thousands more unemployed Albertans, lower levels of public services, harm to the most vulnerable citizens, longer hospital wait times, and more crowded schools.

The 2017 budget from Saskatchewan backs up Notley’s claims.

Saskatchewan Premier Brad Wall has gone in the opposite direction from Alberta, choosing to cut deeply with a harsh austerity budget. The Wall government increased the provincial sales tax from five to six per cent and widened the number of things the tax is charged on to include food and children’s clothing. Municipal grants have been slashed (meaning more cuts to come), and a rural bus service in place for decades has been shut down. Education and health care have seen reductions in their budgets, meaning longer wait times and more crowded hospitals. Fees for long-term care have increased, farmers now pay more for fuel, and alcohol taxes are going way up.

“We’re maintaining a steady hand because we believe that keeping money in the economy is the way to ensure that we come out of the recession faster. And, we think our plan is the more measured approach,” Premier Notley told Postmedia news.

And the Alberta plan is working. While Saskatchewan suffers massive cuts and tax hikes, Alberta is seeing an economic turnaround that is getting attention. Alberta is projected to lead the country in economic growth in 2017 and 2018, while Saskatchewan lags. Jobs numbers have increased in Alberta for each of the last six months, with tens of thousands of part-time jobs being replaced by good paying, full-time employment. The TD Bank has credited the Notley government for the turnaround, saying the stimulus spending by the province has led to a quicker turnaround.

Both Alberta and Saskatchewan are reliant upon energy resources. In both cases, Conservative governments failed to save during good times and argued for austerity measures in bad times.

In Alberta, services and the people who deliver them are protected. In Saskatchewan, public services are crumbling and public employees are filing for Employment Insurance.

Budgets are about political choices, Alberta is growing their economy by choosing to support public services and invest in infrastructure.

Saskatchewan went with cuts to services and tax hikes for everyone except corporations; they didn’t have to inflict so much pain on the people of Saskatchewan by cutting public services, and giving corporations a big tax break – they chose to.